Making Waldorf Education Accessible

For over 20 years, WWS has inspired a love of learning in Whistler’s community and the Waldorf community of Canada. As one of three Waldorf High Schools in Canada, WWS is proud that the community has given us so much hard work and support over the years to be able to offer a Waldorf education to any student that requires it’s unique, warm and nurturing theology.

Every donation made to Whistler Waldorf School directly affects a child’s education. Tuition fees, government and business grants (and a portion of fundraising) all cover the school’s operations budget, which largely consists of teacher salaries and lease payments for operating space. However, we are committed to keeping our fees as low as possible to maintain affordability and keep Waldorf education as accessible as possible.

Partners in Fundraising

Match Contributions & Partner with us

If you own a business in the Sea to Sky, are an employee, or an individual that wants to contribute more, WWS can help you as you help us fundraise for our annual events.

WWS can create a funds matching or specialized donation program for you. The idea is simple. You, your work or your business can help match donations in totality (or up to a certain amount). In return, WWS will advertise your business as a partner of our fundraising campaign to our 1700+ social media followers.

How to partner with us?

- An individual or business decides to raise funds by matching a percentage of funds raised during our Annual Gala to get a corporate or personal tax write-off.

- A local restaurant donates two evening 3-course meals for our Gala silent auction to get extra social marketing and promotion before and during the event.

- An online business offers 10% donation of proceeds back to WWS when their product is purchased through our community E-newsletter.

Contact us for more information or with your idea for how you can help, and in turn how we can help you!

Donate Investments for Tax-savings

A donation of securities or mutual funds is the most efficient way to give charitably. Since capital gains taxes don’t apply, our charity receives the full fair market value when the security is sold, and you get a tax receipt which reflects your larger contribution. This allows you to give more and get more.

Why donate securities?

- Your gift of securities entitles you to a donation receipt for the full market value (resale) of your contribution. Your gift will result in a non-refundable, charitable tax credit that will reduce your income taxes. You can use it in the year of your gift or carry it forward for up to five additional years.

- You pay no capital gains tax on the appreciated value (increased price) of your securities. Donating securities directly to WWS avoids the tax on capital gains, maximizes the return on your investment and protects the tax credits for use against other taxable income.

For information and forms to start your investment donation, please contact our Finance Dept. for more details.

Enrichment Grants

We are fortunate that Whistler’s community groups and businesses provide an opportunity for social enrichment opportunities and grants.

Every year, WWS applies for a number of community grants to help build enrichment opportunities for the students within the school. We are grateful to these organizations for their support, including Vail’s Epic Promise, Resort Municipality of Whistler and the Community Foundation of Whistler.

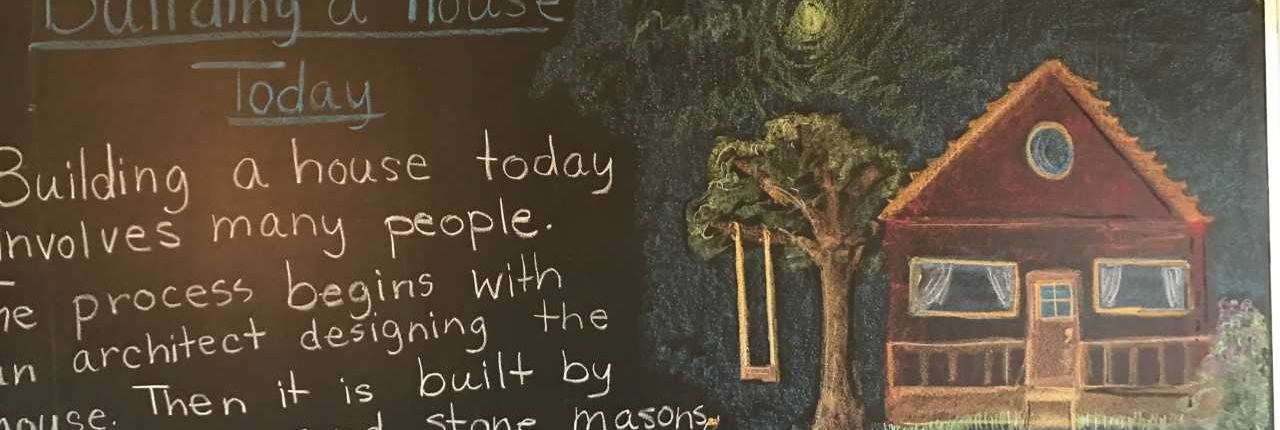

A committed Waldorf School community

Community engagement and support is the cornerstone of a high-quality, independent school education and the healthy growth of the Whistler Waldorf School. The generous financial support we receive from our current families, alumni, alumni parents, friends and community partners goes directly towards expenses not fully covered by tuition alone.

Community Fundraising Events

To support this mission, Whistler Waldorf School puts on an Annual Giving Campaign and Gala Evening Fundraiser during the year to help support student and teacher’s wishlists and capital projects for the school such as outdoor learning spaces, ADST/Tech Program upgrades and much more.

Our community partners and families are some of the most creative givers to the school and students and we would be limited without them!

We encourage our community members to suggest additional ideas for fundraising and get creative: Nearly anywhere we spend money is a worthy support opportunity to consider.

School-based Fundraisers

Every year, parents help organize school fundraisers throughout the year and hot lunch programs where our students directly benefit from the funds raised.

- Gift Cards @ grocery stores

- Holiday cards with Toad Hall Studios

- Westcoast Seeds

- Growing Smiles Plant Sales

- Back to School BBQ

- Bake Sales

- Toy Drives

- Book Fairs

- Creekbread Pizza Fundraiser

We need you:

There are many ways to give and your support will help us continue to offer Waldorf education to families in our community. Support can be monetary or in terms of voluntary assistance with day to day operations.

If you have a fundraising idea, or unique opportunity to contribute, or a skill/trade that you would like to offer for a volunteer service to the school’s operations. we need you!